Your Trusted Payroll Partner

Seamless, modern payroll

Full Service Payroll and HR services for your growing business

We provide comprehensive solutions to help you:

- Streamline your operations through smart payroll solutions,

- Ensure you remain compliant with payroll taxes,

- Simplify HR functions to support a positive work environment

- Keep you protected with seamless workers’ compensation insurance

- Save hours when it comes to employee timetracking

Friendly, hardworking and committed

That’s how our clients describe us. Come meet our Buffalo-based team and find out how we can help you with our small business payroll services!

Come meet us!

Our Services

What We Do

Payroll

Our online payroll services will bring your small business peace of mind and relief.

Human Resources

HR support and guidance to help you create a positive work environment, maintain compliance, and manage employee relations.

Timekeeping

Easily track employee hours, manage schedules, and ensure accurate payroll calculations.

Workers’ Comp Insurance

Seamless Pay As You Go workers’ compensation insurance coverage to protect you and your employees.

Your Trusted Advisor

Our team is here to help should you have any payroll queries for your small business.

Full-Service Payroll

We run a full service payroll company based out of Buffalo, New York, that’s mission-based and puts people first. That means when you come to Computer Payroll, you can access a full suite of services from regular payroll processing, to payroll tax compliance, right through to HR, Workers’ Compensation Insurance and Timekeeping.

But more than that, our friendly team is dedicated to delivering our payroll solutions with people in mind. We promise to put you first, be your trusted resource, and always treat you like a friend (not a number!)

Blog

Recent News

Read the latest news and announcements

4 Tips for Getting Your Business Through Tough Times

If you’re a small business owner whose company hasn’t gone through hard times, that’s great but it’s likely to happen at some point. As much as we dream about being...

Read More

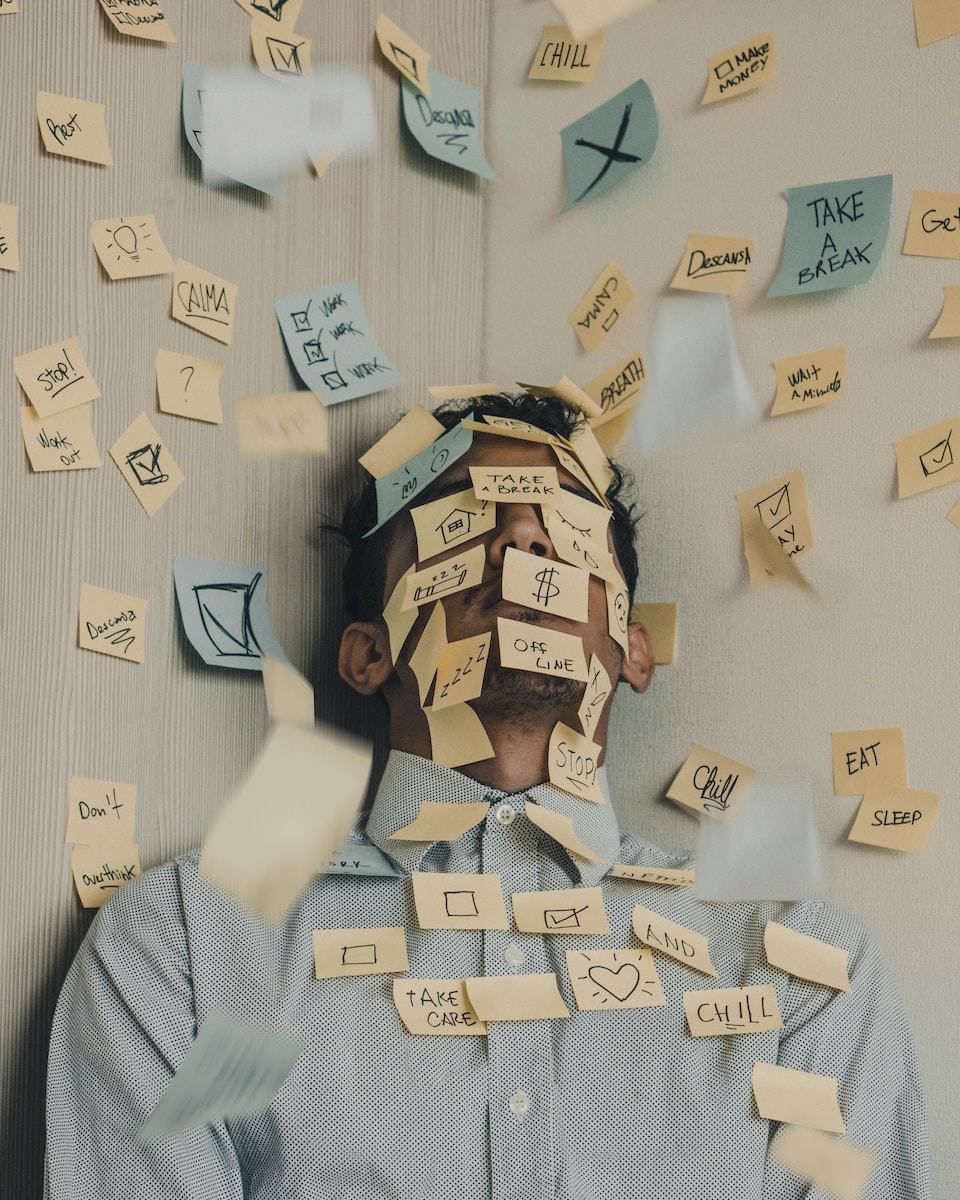

D to the Power of 4 – Four Steps to Better Time Management

Time management skills are increasingly important in a world where people seem to rush headlong from one crisis to another. Add in the effect of social media and addictive computer...

Read More

The ins and outs of employee performance reviews

When you run a small business, you’re involved in your company’s sales, accounting, marketing, and human resources, among other things. Being responsible for human resources isn’t just about hiring and...

Read More